Government Incentives for homeowners

The Canadian government has made financial incentives available to support indiviuduals and families in various areas of life including housing. Understanding and accessing these incentives can impact your financial planning goals.

The government offers several financial incentives, each with their own set of eligibility criteria. To ensure that you're making the most of these opportunities and to fully understand the incentives you qualify for, it's advised that you seek guidance from an accounting professional. Personalized advice can help you navigate these options effectively, aligning them with your own unique financial situation and real estate goals.

Key incentives to consider include:

- First Home Savings Accounts (FHSA's) which are aimed at first time home buyers, the FHSA offers tax advantages to help save for a first home, allowing annual savings up tp $8,000 and a lifetime limit of $40,000. Contributions are tax deductible and withdrawals for a home purchase are tax free. https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/first-home-savings-account.html

- Home Accessibility Tax Credit (HATC) is an incentive aimed at those needing to make accessibility improvements. The HATC provides a credit of up to $3000 on a $20,0000 investment, supporting seniors and indiviuduals with disabilities. HATC

- Home Buyers' Amount (HBA) is an incentive that offers a federal tax reduction of $1,500 for first time homebuyers, applicable on up to $10,000 of the home purchase price, facilitating easier access to homeownership. HBA

- Multigenerational Home Renovation Tax (MHRTC) offers up to $7500 for modifications to create secondary suites for seniors or disabled adults, aiding families in providing a supportive family environment. MHRTC

As a landlord, you can reduce taxable income with property related expensees which may include: advertising, property taxes, insurance premiums, etc. Contact an accountant for what is allowable in your circumstance.

If you are relocating more than 40KM for work or education, you may want to look into deductions for moving expenses.

For detailed guidance, consult an accounting professional.

Categories

Recent Posts

After three rate cuts, is Canada's housing market finally making a comeback?

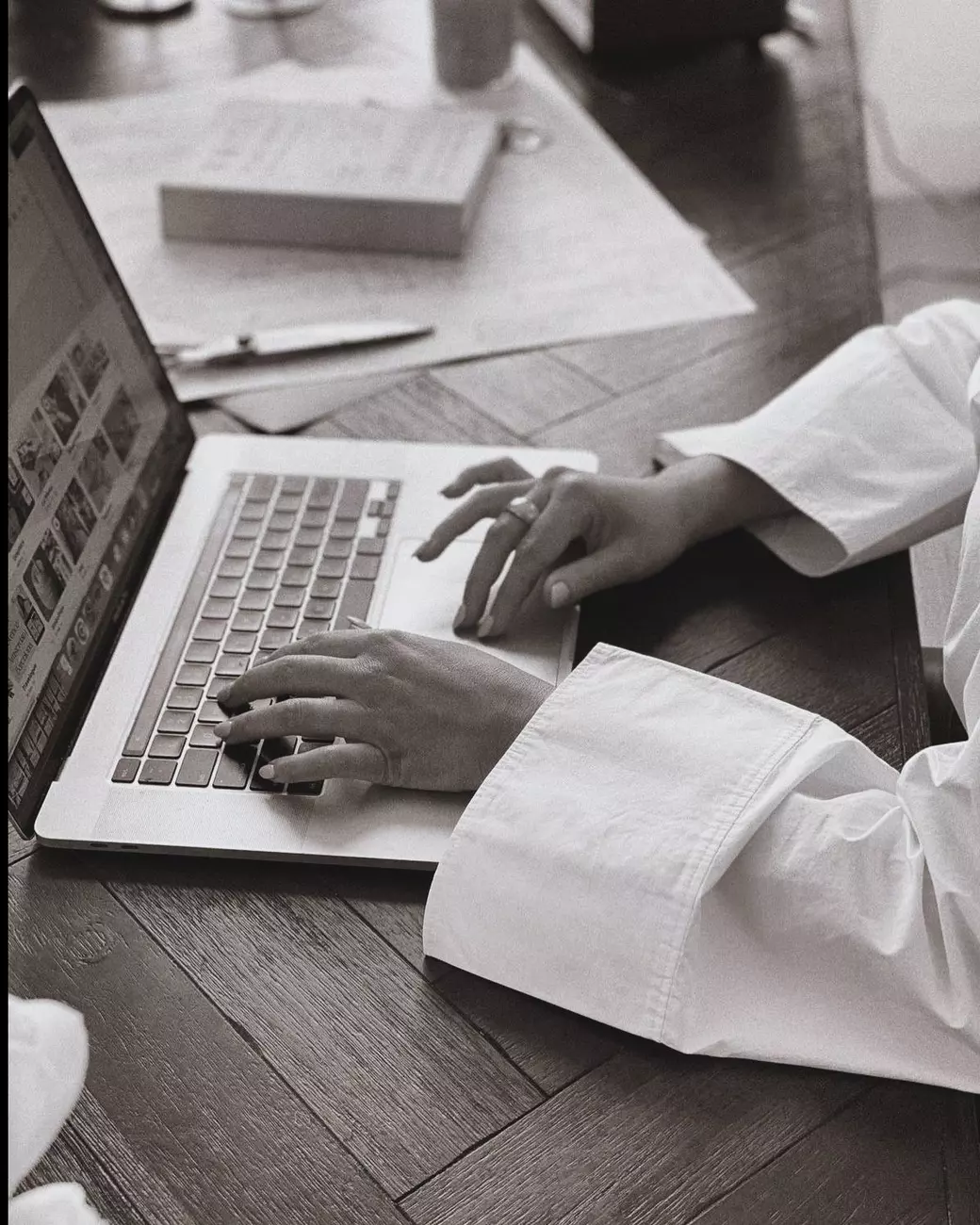

Could the new Federal Budget impede the Bank of Canada anticipated rate cut?

Purchasing a leasehold vs a strata freehold. What are the key differences?

Government Incentives for homeowners

Clyde Port Moody

Should I Downsize? My Experience - Anne Hermary

Should I buy a home in 2022?

You are our number one priority, and I am ready to help you meet your goals. I know you have a choice when choosing a real estate professional to be on your side, and thus, I aim always to exceed your expectations as often as possible when helping you buy or sell a home.